Overview

The Stacks network is a Bitcoin Layer 2 blockchain that enables smart contracts and decentralized applications secured by Bitcoin's proof-of-work consensus. Stacks uses Proof of Transfer (PoX) to anchor its blocks to Bitcoin, creating a programmable layer that inherits Bitcoin's security while enabling DeFi, NFTs, and other smart contract functionalities. The network's native token, STX, powers transactions and enables Stacking, where holders can earn Bitcoin rewards by participating in consensus. Stacks' Clarity smart contract language is designed for security and predictability (contracts being interpreted, not compiled), making it well-suited for financial applications and Bitcoin-secured DeFi.

In 2025, Stacks underwent a transformative year marked by the maturation of sBTC (1:1 Bitcoin-backed asset), the launch of Dual Stacking enabling Bitcoin holders to earn native BTC yield, and the activation of Clarity 4 bringing enhanced smart contract capabilities. Major ecosystem developments included institutional infrastructure integrations with Circle (USDCx), BitGo (custody), Nansen (analytics), and Wormhole (cross-chain), positioning Stacks as production-ready institutional Bitcoin infrastructure.

The network saw significant protocol upgrades including SIP-031 establishing the Stacks Endowment and Treasury Committee, sBTC cap removal unlocking unrestricted Bitcoin liquidity, and Clarity 4 activation with new built-in functions for enhanced security and developer experience. DeFi protocols like ALEX, Zest, Bitflow, and Hermetica saw substantial growth, with sBTC TVL reaching $545 million and over $100M in capital participating in Dual Stacking.

These developments demonstrate Stacks's evolution from a Bitcoin Layer 2 to a comprehensive Bitcoin DeFi infrastructure stack supporting institutional capital deployment and retail yield opportunities.

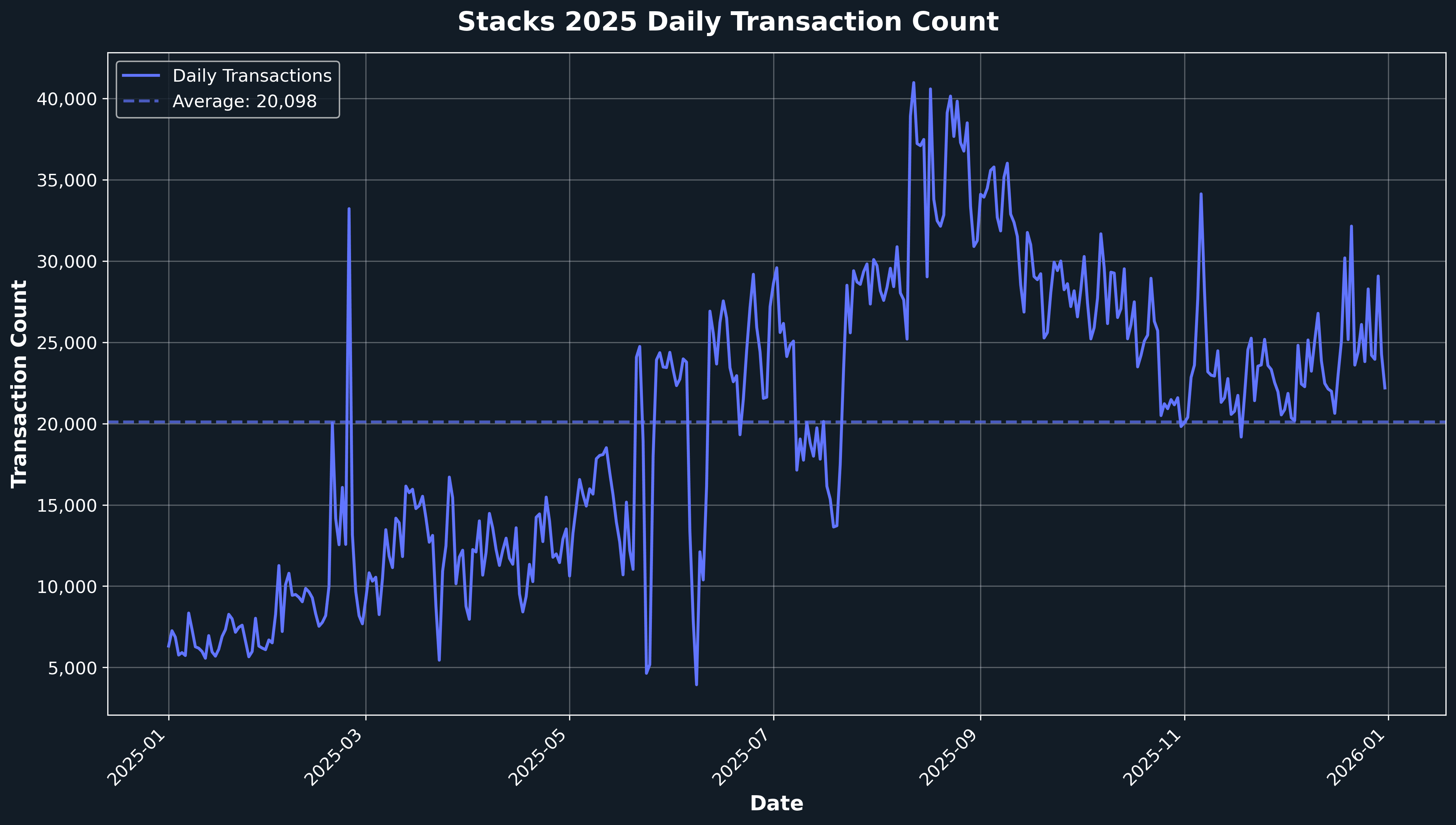

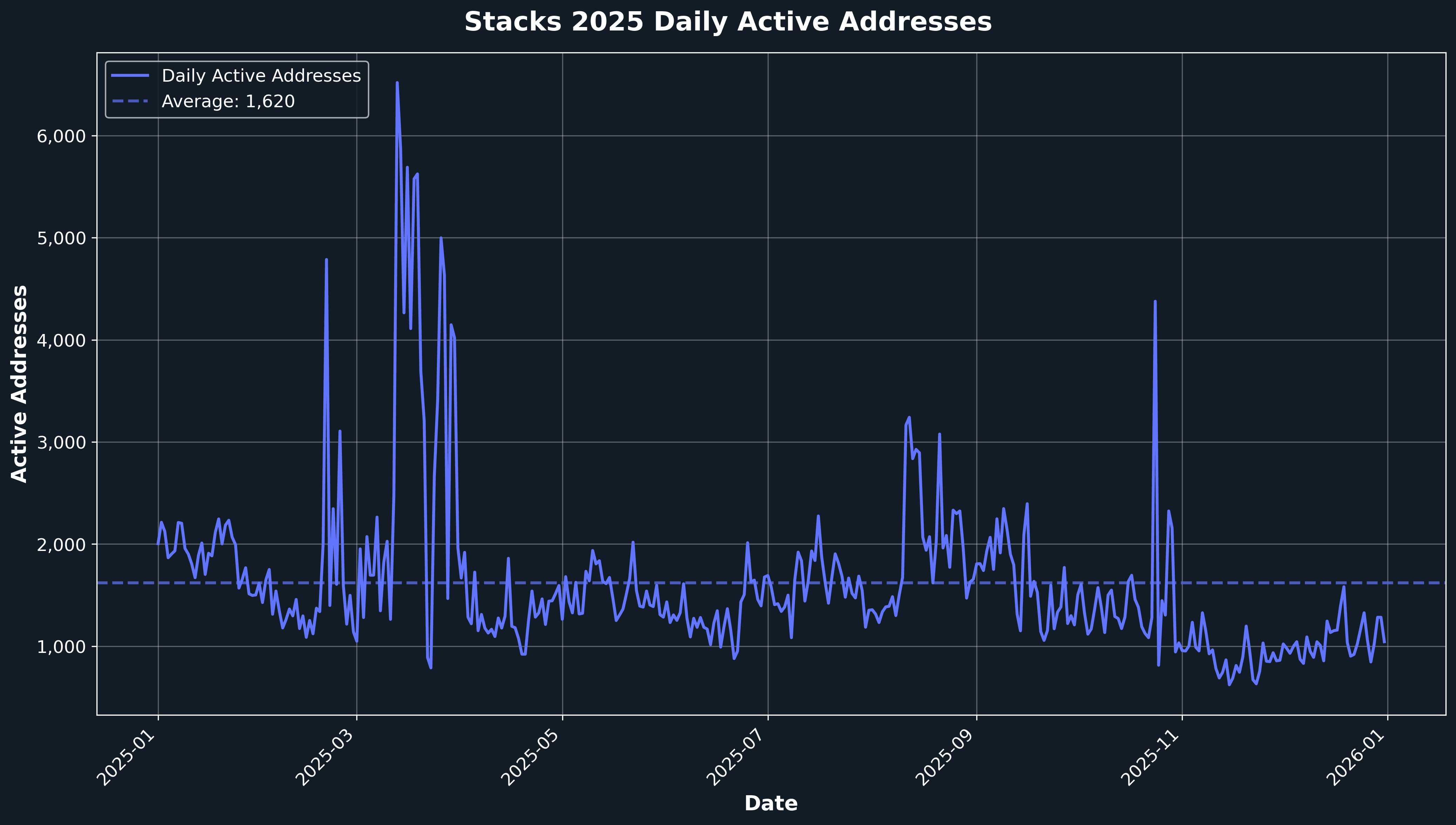

Onchain data reveal sustained network activity throughout 2025, with average daily transactions of approximately 20,000 and peaks reaching over 40,000 transactions per day. Daily active addresses averaged around 1,500, with notable surges during major ecosystem events including sBTC cap increases, Dual Stacking launch, Clarity 4 activation, and institutional integrations.

Key Developments: 2025

Stacks evolved into production-ready institutional Bitcoin infrastructure through live integrations with major providers.

Circle's xReserve launched native USDC (USDCx) on Stacks, bringing Tier 1 stablecoin functionality to Bitcoin and making Stacks the only Bitcoin L2 in Circle's xReserve pilot program. Bitfinex provides exchange-grade liquidity, Immunefi offers ongoing security programs, BitGo supports institutional custody for BTC and sBTC, WalletConnect expands STX Stacking access, Nansen brings professional analytics, and Wormhole enables cross-chain liquidity for sBTC and STX. These integrations remove operational barriers for institutions to deploy Bitcoin capital productively. The network achieved mainstream market exposure through Coinbase 50 Index and Bitfinex listings, with Grayscale's Stacks Trust trading on OTC Markets as the first U.S. investment product for STX exposure. Further, Stacks announced an integration with Fireblocks to help unlock institutional bitcoin DeFi.

Major protocol upgrades transformed Stacks' capabilities throughout 2025.

Major protocol upgrades transformed Stacks' capabilities throughout 2025. SIP-033 and SIP-034 officially activated at Bitcoin block 923,222, bringing Clarity 4 live on Stacks with five powerful new functions: onchain contract verification, allowing contracts to set post-conditions, converting simple values into ASCII strings, getting the timestamp of the current block, and native passkey integration with secp256r1-verify. The Stacks community approved SIP-033 (Clarity 4) with near-unanimous support (99.9%), enabling developers to build more sophisticated Bitcoin DeFi applications with enhanced security.

On September 16, 2025, the cap on sBTC was removed, unlocking open, trust-minimized Bitcoin liquidity on Stacks by removing the 5,000 BTC ceiling and enabling unrestricted inflows and outflows, with the minimum deposit threshold reduced from 0.01 BTC to 0.001 BTC to make the protocol more accessible. At the time of uncapping, sBTC had $545 million USD TVL secured across 7,408 holders and 62+ BTC distributed in rewards since launch.

Dual Stacking launched on Stacks

Dual Stacking is the first step in enabling Bitcoin holders to earn BTC-denominated rewards paid in sBTC through Stacks' Proof of Transfer consensus, making Stacks the first protocol where Bitcoin earns Bitcoin. Bitcoin holders can mint sBTC, enroll in Dual Stacking to earn base Bitcoin rewards, and boost rewards by stacking STX (up to 10x multiplier) or deploying into DeFi, with all rewards distributed in sBTC redeemable 1:1 for BTC. The mechanism leverages PoX which has moved over 4,000 Bitcoin onchain since 2021. Over $100M of sBTC + STX capital is now participating in Dual Stacking, all earning Bitcoin rewards, with Dual Stacking ranking #1 among top Bitcoin yield strategies paying out in BTC, and plans to further innovate how users can participate in Bitcoin staking.

The Dual Stacking Litepaper was also released, introducing a new way to earn Bitcoin rewards directly through Stacks. Based Dollar (BSD) integrated Dual Stacking, giving sBTC collateral a 5% yield boost, and launched a new sBTC/BSD pool on Bitflow.

New Stacks Endowment

SIP-031 voting concluded with over 310M STX cast in support, a record in total STX voting power, with the vote passing at 97.5% in favor to create the new Stacks Endowment that will enable the next phase of growth while becoming a long-term backstop for the ecosystem. The SIP creates 500M STX over five years for the Endowment, enabling investment in marketing, integrations, DeFi incentives, and developer incentives, with the hard fork expected at Bitcoin block 907740 (projected for July 29th).

The Stacks Treasury Committee approved a $27M 2026 operating budget and 25M STX working-capital allocation, with allocations prioritizing engineering and security (35.2%), network growth and marketing (22.2%), and working capital for DeFi deployment (23.4%). The new Stacks operational entity was named Stacks Labs, with Hiro CEO and SIP-031 co-author Alex Miller announced as Interim CEO to organize the setup. The Stacks Foundation will host a one-time grant program focused on top applications, and the budget allocation for the next round of DeGrants was doubled. Further, the Stacks Endowment also just announced its Grants programs to support builders within the ecosystem.

Developer tools and infrastructure saw significant improvements throughout 2025.

Developer tools and infrastructure saw significant improvements throughout 2025. Chainhooks 2.0 moved into Beta after months of stable performance, bringing a new RESTful API, typed JavaScript SDK, deep observability with Platform dashboards, and improved scalability, with the system supporting roughly 4× more registered chainhooks than v1.

Hiro's Token Metadata API solved the problem of stale metadata across the Stacks ecosystem by implementing SIP-019, which standardizes metadata update notifications using Clarity's print function.

Stacks Blockchain API version 8.13.4 was released to support Clarity 4 transactions ahead of the Stacks 3.3 hard fork activation.

Xverse's Sats Connect passed 2M downloads, becoming one of the most used ways for developers to integrate Bitcoin wallets.

Stacks achieved the #5 ranking among fastest-growing developer ecosystems, demonstrating strong builder momentum, with Electric Capital's data showing Stacks comfortably leading Bitcoin projects in developer activity and ranking in the top 20 crypto projects by developers.

Ecosystem growth accelerated with builder programs and global presence.

Ecosystem growth accelerated with builder programs and global presence. Stacks and Talent Protocol launched a rewards program for builders from December 10-30, featuring three hands-on challenges designed to explore new tools and earn STX rewards, with weekly rankings and tiered STX reward pools.

Expedition 31 brought new opportunities for builders including meetups, developer courses, and the Stacks Vibe Coding Hackathon with $25,000 in prizes, powered by Stacks Ascent.

The Stacks Hacker House opened in Buenos Aires with workshops on Clarity, sBTC, Chainhooks, Hiro APIs, and AI-powered coding, with eleven teams shipping real projects built with Clarity at Demo Day at the Bitcoin Builders Conference.

Stacks is bringing orange activations to major Bitcoin and crypto gatherings across the world, with major events including Bitcoin Asia in Hong Kong, Building on Bitcoin Singapore during Token2049, Bitcoin Builders: Buenos Aires during DevConnect 2025, Bitcoin Amsterdam, Bitcoin MENA in Dubai, and Bitcoin 2025 in Las Vegas. Let Africa Build (LAB), Africa's first Bitcoin development hub and incubator, established a strong pipeline with 300+ graduates, 95% job placement, and over N128M raised to date.

Cross-chain infrastructure and DeFi ecosystem expansion gained momentum.

Wormhole, a blockchain interoperability protocol that secured $225 million in funding at a $2.5 billion valuation, integrated Stacks, enabling sBTC and STX to move across other blockchains using Wormhole's infrastructure, beginning with Solana and Sui, with tokens adopting Wormhole's Native Token Transfer (NTT) standard for native issuance across major DeFi ecosystems.

DeFi protocols showed strong growth with Zest officially having over 650 sBTC flowing through their lending protocol, Hermetica reporting USDh yield returns consistently above 15% and launching its hBTC vault, an onchain trading strategy that converts all profits back into Bitcoin, and Bitflow launching their community-powered education hub for Bitcoin DeFi.

MEXC, one of the largest global exchanges, listed sBTC with the sBTC/USDT trading pair officially live.

The Stacks DeFi ecosystem launched a new season for STX DEFI SZN, an onchain quest campaign with a 50,000 STX reward pool.

Ecosystem

DeFi

- DeFi protocols on Stacks demonstrated strong growth and innovation throughout 2025. Bitflow introduced Bitflow HODLMM, a concentrated liquidity engine, and reported being the top DEX on Stacks with $315M+ volume and 30K+ unique users. Based Dollar (BSD) integrated Dual Stacking, giving sBTC collateral a 5% yield boost, and launched a new sBTC/BSD pool on Bitflow, with Bitflow integration with BUSD providing more liquidity, tighter peg behavior, and better tools for borrowers. Zest officially has over 650 sBTC flowing through their lending protocol, offering up to 3.5% APY in Bitcoin yield, with over $5M in active borrowing positions and 1,300+ zero bad debt liquidations. Hermetica reported USDh yield returns consistently above 15%, with the Bitcoin-backed Stacks stablecoin delivering 8-16% APY, and launched its hBTC vault, an onchain trading strategy that converts all profits back into Bitcoin. Granite shared a strong >15% APY for its yield product and launched protocol-level withdrawal caps to further reduce exploit risk. ALEX surpassed $2.7 billion in Total Transaction Volume, with Surge 4 live and over 1,000,000 ALEX in rewards, while the ALEX Lab Foundation sought governance approval to allocate protocol revenue toward essential operational costs in response to market conditions. StackingDAO surpassed 100 million STX in TVL and celebrated distributing >10,000,000 STX to stackers via stacking.

- sBTC ecosystem expansion accelerated with the cap removal enabling unrestricted Bitcoin liquidity flows. The sBTC cap was officially removed, marking a major milestone for the Stacks ecosystem, with Bitcoin now able to move freely in and out, enabling builders and users to introduce new opportunities. Moso integrated Stacks' sBTC, bringing Bitcoin rewards to 2,000+ top stores and enabling users to earn 100% back in sBTC while shopping. Gate listed Stacks' programmable BTC, bringing sBTC to 38 million traders worldwide. Institutional sBTC investors were revealed, with SNZ, UTXO Capital, Jump Crypto among leaders to deposit early in sBTC, unlocking Bitcoin DeFi utility. sBTC withdrawal functionality went live, enabling users to withdraw their sBTC back to Bitcoin, with the protocol supporting $545 million USD TVL secured across 7,408 holders and 62+ BTC distributed in rewards since launch.

Enterprise & RWAs

- BitGo has integrated sBTC, allowing institutions to put their Bitcoin liquidity to productive use, with leading digital assets solution Hex Trust successfully integrating Stacks. Hermetica 2.0 is now live, featuring a complete rebuild of the app to offer an improved UX. Brotocol bridge has officially launched, connecting Stacks with other chains. Granite is launching a program that offers incentives based on users' deposit amounts. At Token2049 Singapore, Stacks leaders presented the "Productive Bitcoin Treasury Companies" thesis, explaining how Bitcoin treasury companies are turning to Stacks to make their BTC productive, with Rena Shah highlighting how public treasury companies operate above ETFs with the ability to make Bitcoin productive through Stacks.

Onchain Data

Daily Transactions

Stacks demonstrated robust transactional activity throughout 2025, with an average of approximately 20,000 daily transactions and peaks reaching over 40,000 transactions per day. The year showed consistent throughput with notable activity spikes during major ecosystem developments including sBTC cap increases (February, May, September), Dual Stacking launch (October), Clarity 4 activation (November), and institutional infrastructure integrations.

The network maintained resilience, demonstrating Stacks's capacity to handle diverse workloads from DeFi protocols (ALEX, Zest, Bitflow) to exchange activity and cross-chain infrastructure. This sustained activity aligns with the network's expanding role in Bitcoin DeFi, where protocols leverage Stacks's Bitcoin security and smart contract capabilities to unlock productive uses for Bitcoin capital.

Daily Active Addresses

Stacks maintained a healthy base of active addresses throughout 2025, averaging approximately 1,620 daily active addresses with peaks reaching 6,518. The year showed periodic surges in user activity, particularly during major ecosystem developments including sBTC cap increases, Dual Stacking launch, Clarity 4 activation, and institutional infrastructure integrations. These activity spikes demonstrate growing user engagement across diverse use cases, from DeFi protocols (ALEX, Zest, Bitflow, Hermetica) to exchange activity and cross-chain infrastructure. The consistent user base reflects Stacks's expanding appeal as institutional Bitcoin infrastructure, with integrations from Circle, BitGo, Nansen, and Wormhole bringing professional-grade tools and services to the network.

Top Entities by Users and Transactions

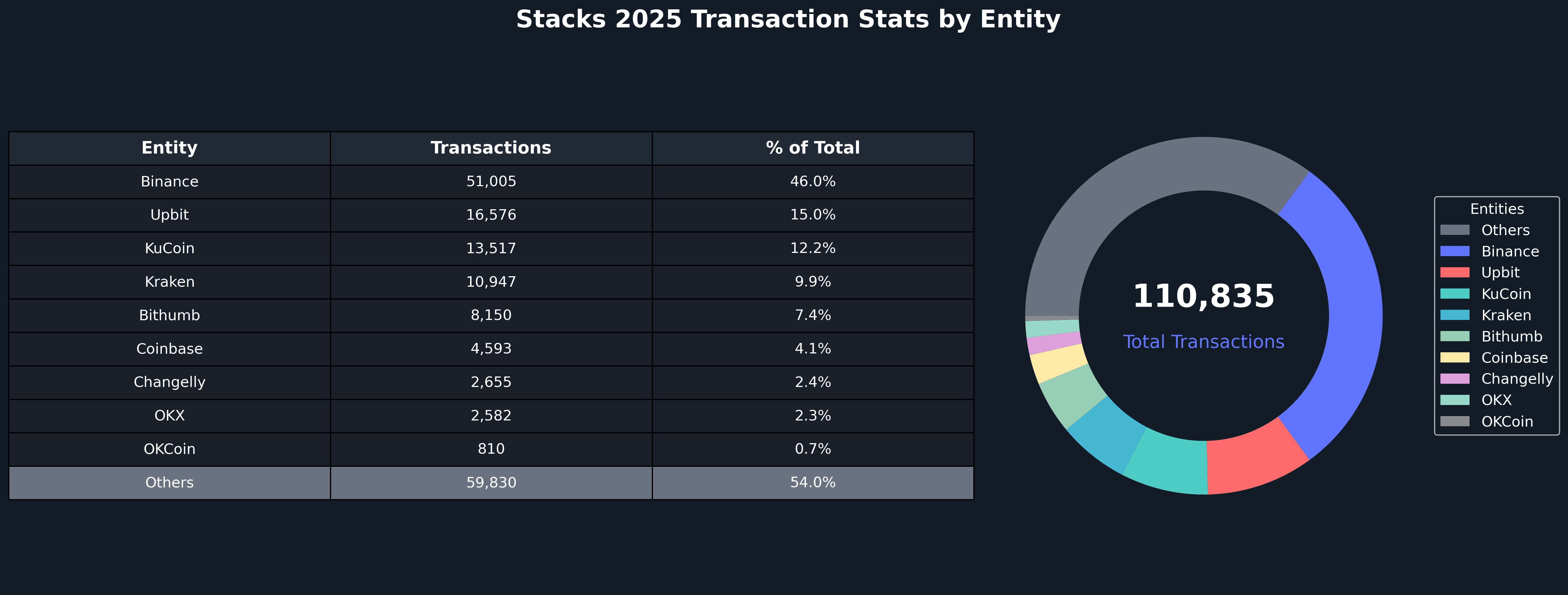

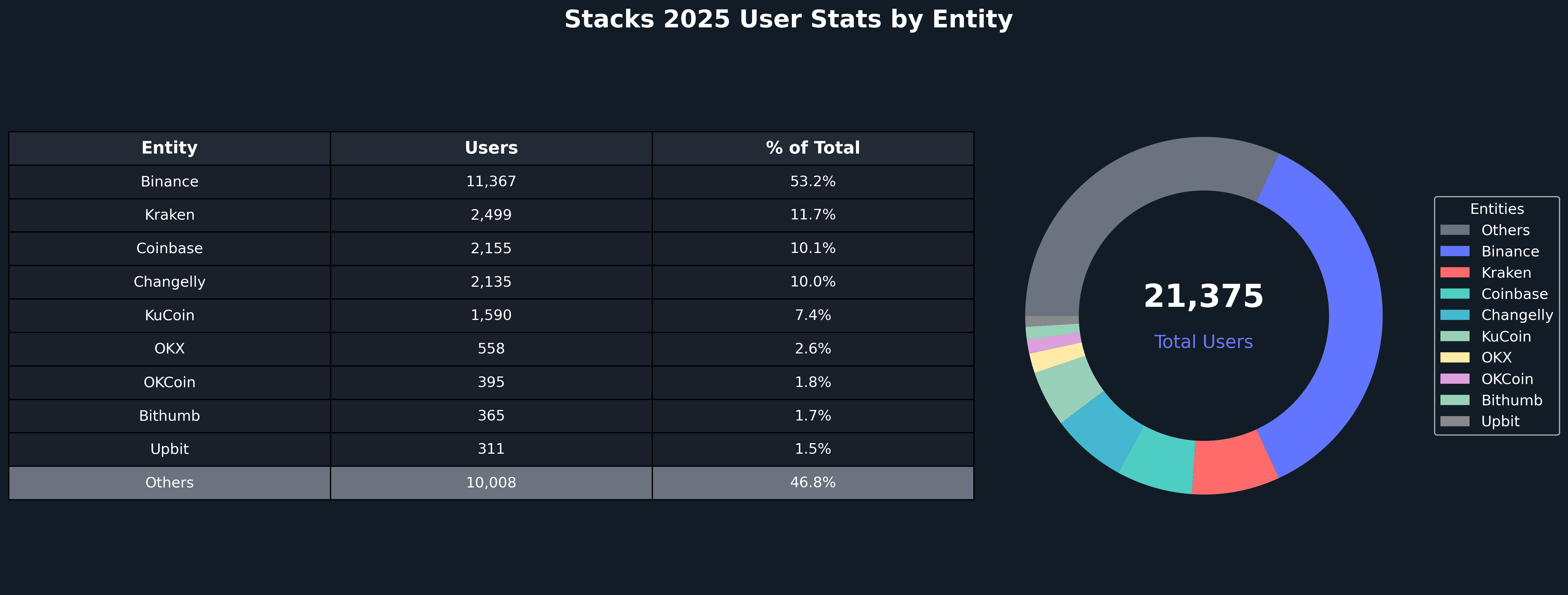

Stacks's top entities by users and transactions highlight a diverse ecosystem anchored by centralized exchanges, DeFi protocols, and cross-chain infrastructure. Binance led both transaction volume (51,005 transactions) and user activity (11,367 unique users), reflecting Stacks's growing integration into mainstream crypto infrastructure. Other major exchanges including Upbit (16,576 transactions, 311 users), KuCoin (13,517 transactions, 1,590 users), and Kraken (10,947 transactions, 2,499 users) demonstrated significant activity, indicating broad exchange support for STX and sBTC trading. The ecosystem's distribution reinforces Stacks's dual role as both a Bitcoin DeFi infrastructure layer and a bridge to mainstream crypto markets, with exchange activity serving as critical onramps for capital deployment into Bitcoin-secured DeFi protocols.

Closing Thoughts

2025 has marked a transformative year for Stacks, positioning the network as the leading infrastructure provider for Bitcoin DeFi and institutional Bitcoin capital deployment. The network's robust onchain metrics, averaging approximately 20,000 daily transactions and 1,600 daily active addresses, demonstrate sustained ecosystem engagement and growing adoption across diverse use cases. The year's strategic developments reflect a clear evolution toward institutional-grade Bitcoin infrastructure: from Circle's USDCx launch to BitGo's custody support, from Nansen's analytics integration to Wormhole's cross-chain capabilities, Stacks has systematically removed operational barriers for institutions to deploy Bitcoin capital productively.

The maturation of sBTC represents a pivotal achievement, with the cap removal in September unlocking unrestricted Bitcoin liquidity and positioning sBTC as fully open liquidity accessible to more users, developers, partners, and institutions. The launch of Dual Stacking in October marked a major step toward making Bitcoin productive capital, enabling Bitcoin holders to earn BTC-denominated rewards paid in sBTC through Stacks' Proof of Transfer consensus. With over $100M of sBTC + STX capital participating in Dual Stacking and sBTC TVL reaching $545 million, the network has demonstrated strong product-market fit for these initial Bitcoin yield opportunities.

The activation of Clarity 4 through SIP-033 and SIP-034 brought enhanced smart contract capabilities to Stacks, introducing five powerful new functions that enable developers to build more sophisticated Bitcoin DeFi applications with enhanced security. The establishment of the Stacks Endowment through SIP-031 creates a long-term sustainability mechanism, with 500M STX allocated over five years to enable investment in marketing, integrations, DeFi incentives, and developer incentives. This structural alignment, combined with the formation of Stacks Labs as the new operational entity, establishes the foundation for continued growth and ecosystem development.

Onchain data reveals a maturing ecosystem where centralized exchanges serve as primary onramps for capital, while DeFi protocols drive productive use cases for Bitcoin. The network's capacity to handle diverse workloads, from high-frequency exchange transactions to DeFi protocol interactions, demonstrates its technical readiness for institutional-scale deployment. As Stacks continues to bridge Bitcoin's $2 trillion market cap with productive DeFi opportunities through partnerships, infrastructure development, and community-driven innovation, the network enters 2026 well-positioned to advance its mission of making Bitcoin productive capital while maintaining Bitcoin's security and decentralization principles.