Introduction

Aptos is a Layer-1 blockchain engineered to provide secure, scalable, and high-performance infrastructure for internet-scale applications. Built with the Move programming language and a modular execution architecture, Aptos emphasizes parallelism, low latency, and predictable costs. It holds records for the most blockchain transactions in a single day and has achieved over 20,000 transactions per second (TPS) on mainnet, enabling developers to build applications that require real-time responsiveness and massive throughput.

In 2025, Aptos strengthened its position as a production-ready blockchain, advancing protocol performance, expanding its ecosystem, enhancing developer support, and aligning with regulatory standards.

This report examines the key technical developments, ecosystem milestones, and onchain activity that shaped Aptos in H2 2025, providing a structured view of how the network is positioning itself as foundational infrastructure for next-generation financial applications, global payments, and decentralized services.

Key Developments: H2 2025

- Aptos reached sub-50 millisecond block times on mainnet in December, making it the fastest Layer 1 blockchain. The network achieved $1.8 billion in stablecoin market cap, $1.2 billion in tokenized RWAs, and surpassed 4 billion lifetime transactions with zero downtime since 2023. In 2025, Aptos introduced new category-defining protocols like Decibel (fully onchain trading engine) and Shelby (decentralized hot storage) which will is expected to launching on mainnet

- India Blockchain Week 2025 highlighted India's position as a pivotal Web3 market. Reliance Jio is exploring blockchain integration for 500M users. KGeN has 38.9 million registered users and 800,000 daily active users, processing 876 million data points. STAN reached 30M users and 1.2M creators. Santa Browser features a 'Browse-to-Earn' engine. The Federation of Telangana launched an Aptos-based skill wallet pilot for 20,000 students and a rural employment initiative serving 80 million workers. Aptos Foundation committed $15 million to India's builder ecosystem in 2025.

- Aptos Labs introduced major protocol upgrades including Archon (30ms inclusion confirmations, ~10ms block times), Block-STM v2 (8X capacity improvement), Encrypted Mempool (privacy by default), Event-Driven Transactions (native automation layer), and Namespaces (distinct networks sharing single consensus). The Aptos Foundation introduced an Innovation-Enabling Source Code License: code is publicly available immediately, non-commercial for the first 4 years, then automatically converts to Apache 2.0. This gives the ecosystem a head start while enabling broader industry collaboration.

- Aptos Assembly is a four-week sprint program for early-stage founders to turn ideas or hackathon projects into real products. The program includes specialized mentorship, weekly product reviews, structured development path, go-to-market support, and Demo Day presentations. Teams completing the program may receive up to $50K in non-dilutive, milestone-based grant funding, plus priority access to accelerator programs. Applications are currently being accepted for the Q1 2026 cohort.

- The Aptos Foundation selected 41 ambassadors from over 2,000 applicants for the Fall 2025 Cohort of the Aptos Collective. The new members include builders, creators, and community leaders from around the world who will onboard new users, share their vision, and advance the Aptos community. The cohort represents the global, diverse nature of the Aptos ecosystem.

- Aptos Experience: NYC 2025 featured prominent speakers including Laura Shin (Unchained Podcast) with Avery Ching, Kim Milosevich (A16z crypto) and Boys Club co-founders, Tom Schmidt (Dragonfly), Diogo Monica (Haun Ventures), Diego Perez de Ayala (Frictionless Capital), Michael Sonnenshein (Securitize), Thomas Chevallier (BlackRock), Kevin Bowers (Jump Trading), and Austin Federa (DoubleZero). The event included live podcasts, investor discussions, systems design masterclasses, and builder workshops. The Builder House offered hands-on workshops, 1:1 Office Hours, and the AE Builder Scholarship program for students and developers.

- Four new payment providers integrated Aptos: Yellow Card (largest licensed stablecoin infrastructure in Africa, serving 20 countries), Coins.ph (16M+ users in Philippines), Bitso (9M customers in Latin America, US-Mexico remittance corridor), and SpherePay (stablecoin payments for fintechs). These integrations enable instant, low-cost stablecoin transfers for millions of users, reducing remittance costs and improving access to digital commerce. Aptos' sub-second finality, sub-cent fees, and scalability make it ideal for global payments infrastructure, advancing the vision of borderless money movement.

- The CTRL+Move Hackathon (August 4 - October 3, 2025) offered $100,000+ in prizes for DeFi innovation on Aptos. Project ideas included: Trading & Market Infrastructure (matching engines, CLOBs, new order types, capital-efficient vaults, DeFi dashboards, developer tooling); New DeFi Products (RWA marketplaces, prediction markets, social investing apps, reward-based vaults, dynamic liquidity systems, mobile-first interfaces, trading bots); and Payments & Value Transfer (real-time payroll, cross-border remittances, embedded wallets, on/off ramps, smart payment flows). Winners were announced October 16 at Aptos Experience.

- Aptos Foundation launched the Aptos Payments Grant track, offering up to $150,000 in milestone-based funding for founders building next-generation payment infrastructure. Grants include gas station credits, security audit support (up to $25K), technical mentorship from Aptos engineers, and founder enablement via accelerators. Aptos offers $1.41B in stablecoins (+11x YoY), 125ms block times, 19,000+ peak TPS, $0.0005 average fees, and $5B DEX volumes in June. The program targets full-time founders building alternatives to legacy payments, making stablecoins usable in commerce, and building open-source tools or Aptos-native integrations.

- The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) passed the Senate 68-30 on June 17 and became law on July 18, creating the first comprehensive federal framework for payment stablecoins. The Act requires 1:1 backing with USD or Treasuries, redemption procedures, monthly reserve reports, AML/KYC compliance, and freeze/burn capabilities. Aptos' Fungible Asset Standard was designed with these capabilities from day one, supporting freeze/burn, transfer restrictions, audit trails, and permission controls. Aptos has $1.4B+ in stablecoin liquidity, $532M+ in tokenized RWAs, >19K TPS, and 326M transactions in a single day. Premier institutions like BlackRock, Apollo/Securitize, Franklin Templeton, and PACT Protocol have chosen Aptos.

Ecosystem

DeFi

- KGeN is building a verified distribution protocol called VeriFi, powered by the Proof of Gamer Engine (POGE). The platform has processed 876 million data points, with 38.9 million registered users and nearly 800,000 daily active users, making it one of the most widely adopted protocols in Web3. KGeN raised $43.5M from investors including Jump Crypto, Accel and Aptos Labs, with 6.6M unique active wallets and $22.7M proof of treasury. The platform enables biometric-based onboarding, programmable loyalty rewards, and decentralized storefronts through its K-Store.

- Thala launched its Concentrated Liquidity Market Maker (CLMM) on Aptos, introducing range-based liquidity provisioning that enables deeper liquidity and reduced slippage. The protocol also introduced xLPTs (yield-bearing, transferable LP tokens) built on Aptos Dispatchable Fungible Assets standard, with deposits reaching $50M on Echelon. Thala contributes open-source tools including Surf (TypeScript interfaces), Safely (multisig manager), FixedPoint64 (math library), and Move Integers, strengthening the Aptos developer ecosystem. The protocol plans to relaunch ThalaLaunch for decentralized bootstrapping.

- Aptos surpassed $.8 billion in stablecoin market cap in 2025, representing a 500% year-over-year increase. The network supports the world's three largest stablecoins natively: USDT (75% of total supply), USDC, USD1, USDG0, PYUSD0 , and USDe . .

- Backpack Exchange launched on Aptos with support for APT, offering professional trading infrastructure including spot and perpetual futures markets, lending/borrowing with Auto Lend feature, fiat on/off-ramps (USD to USDC at 1:1 with zero fees), cross-collateral and cross-margin capabilities, and real-time proof of reserves with third-party auditing by OtterSec.

- PACT Protocol migrated to Aptos, bringing over $1 billion in onchain assets on day one. The protocol has surpassed $1.89 billion in total loans issued onchain and $610 million in active loans. PACT enables fintech lenders, institutional investors, and capital market participants to issue, manage, and securitize loans directly onchain, reducing costs and increasing transparency. The protocol leverages Aptos' sub-second finality, cost efficiency (fraction of a penny fees), Move language security, and native USDC/USDT support. PACT utilizes BitGo for custody and compliance, serving 1,500+ institutional clients worldwide.

- Aave V3, the leading DeFi lending protocol with over $70 billion in net deposits, launched on Aptos as its first non-EVM deployment. Developed by Aave Labs in collaboration with Aptos Foundation, Aave V3 was re-implemented in Move programming language. At launch, it supports native USDC, USDT, APT, and sUSDe. The deployment underwent multiple audits and launched a $500K bug bounty program. Aave on Aptos opens new collateral markets, particularly for liquid staking tokens (only 8.1% of APT is in LSTs vs 76% directly staked). The integration includes Chainlink Price Feeds for secure markets.

- Panora Exchange introduced automated swaps on Aptos with two key features: Limit Orders (set target prices for automatic execution) and Dollar-Cost Averaging (DCA) for scheduled recurring swaps. Panora is the first platform on Aptos to deliver automation at the point of execution. The platform features a robust swap aggregator that sources liquidity and optimal pricing across Aptos DEXs, ensuring trades execute at the best available prices. These capabilities enable smarter trading experiences, reduce volatility risk, and eliminate emotionally driven decisions, elevating DeFi UX for everyday and professional traders.

- Echelon holds over $200M in deposits and serves as the capital coordination layer for Aptos DeFi. The protocol leads in stablecoin liquidity, supporting native USDC, USDT, yield-bearing assets like sUSDe ($90M+ deposits), and composable LP collateral (xLPTs). Echelon enables BTC-backed lending with over $100M in BTC-based collateral across SBTC, xBTC, WBTC, and aBTC. The protocol features isolated markets for volatile/experimental assets and was selected for Aptos Foundation's LFM program. The upcoming roadmap includes structured products, fixed yield strategies, and curated vaults for institutional users.

- LayerZero introduced WBTC on Aptos via its Omnichain Fungible Token (OFT) standard, providing a direct path for Bitcoin to access Aptos DeFi. WBTC-OFT uses a unified burn-and-mint flow (no lock-ups, no extra wrappers, 1:1 supply) and is secured by BitGo's institutional custody and LayerZero's Decentralized Verification Network. Users can bridge WBTC via Stargate or swap on Aptos DEXs. Combined with OKX's xBTC, Aptos now offers two composable pathways for Bitcoin into DeFi. Aptos has over $430M in BTC-backed assets, $1.35B in stablecoin liquidity, and support from leading protocols like Aries, Echo, and Hyperion.

- Hyperion is a hybrid DEX combining Concentrated Liquidity Market Maker (CLMM) and Orderbook models, built on Aptos' high-performance infrastructure. Since mainnet launch, Hyperion has surpassed $130M in TVL (top 10 DeFi projects on Aptos), $7B in lifetime trading volume, and ranked top 12 among all DEXes by trading volume in June. The platform offers Hyperion Vaults (automated liquidity strategies), an Aggregator (sources liquidity across multiple Aptos DEXs), and CLMM pools in partnership with Moar Market. Hyperion has integrated with Kofi Finance and Amnis Finance for liquid staking and joined Aptos Foundation's LFM program for token generation event support.

- Co-developed by Decibel Foundation and Aptos Labs, Decibel is a fully onchain trading engine that unifies spot, perps, and margin into a single programmable, global platform. In November 2025, Decibel launched its Testnet, introducing core protocol features and enabling users to interact directly with the system, including user-managed vaults, onchain risk controls, and a programmable backend that developers can build on and monetize. Decibel’s Mainnet launch is anticipated in Q1 2026.

- Assets and strategies continue to grow across Aptos. To name a few, OKX launched xBTC and Echo launched aBTC covered call options.

Onchain Data

Aptos demonstrated strong network activity throughout H2 2025, maintaining consistent transaction volumes and active user engagement. The network processed millions of transactions daily, with daily active addresses reaching significant peaks during key periods.

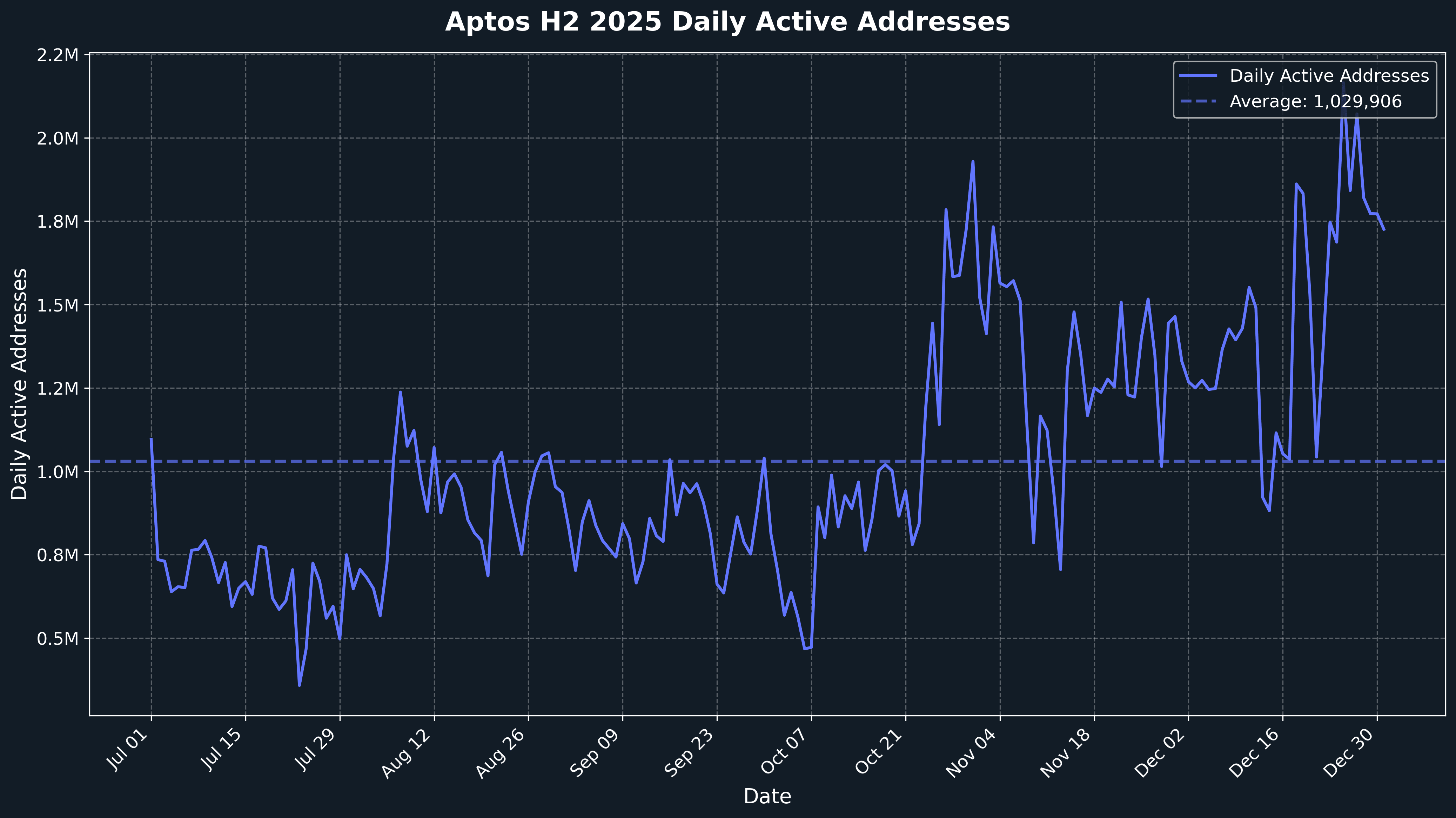

Daily Active Addresses

Throughout H2 2025, Aptos maintained robust daily active address counts, with values ranging from approximately 350,000 to over 2 million addresses per day.

The network experienced notable activity surges, particularly in early August 2025, when daily active addresses exceeded 1 million on multiple consecutive days, peaking at over 2 million addresses. This period of heightened activity coincided with several major ecosystem developments, including the CTRL+Move hackathon launch, major protocol integrations, and ecosystem events.

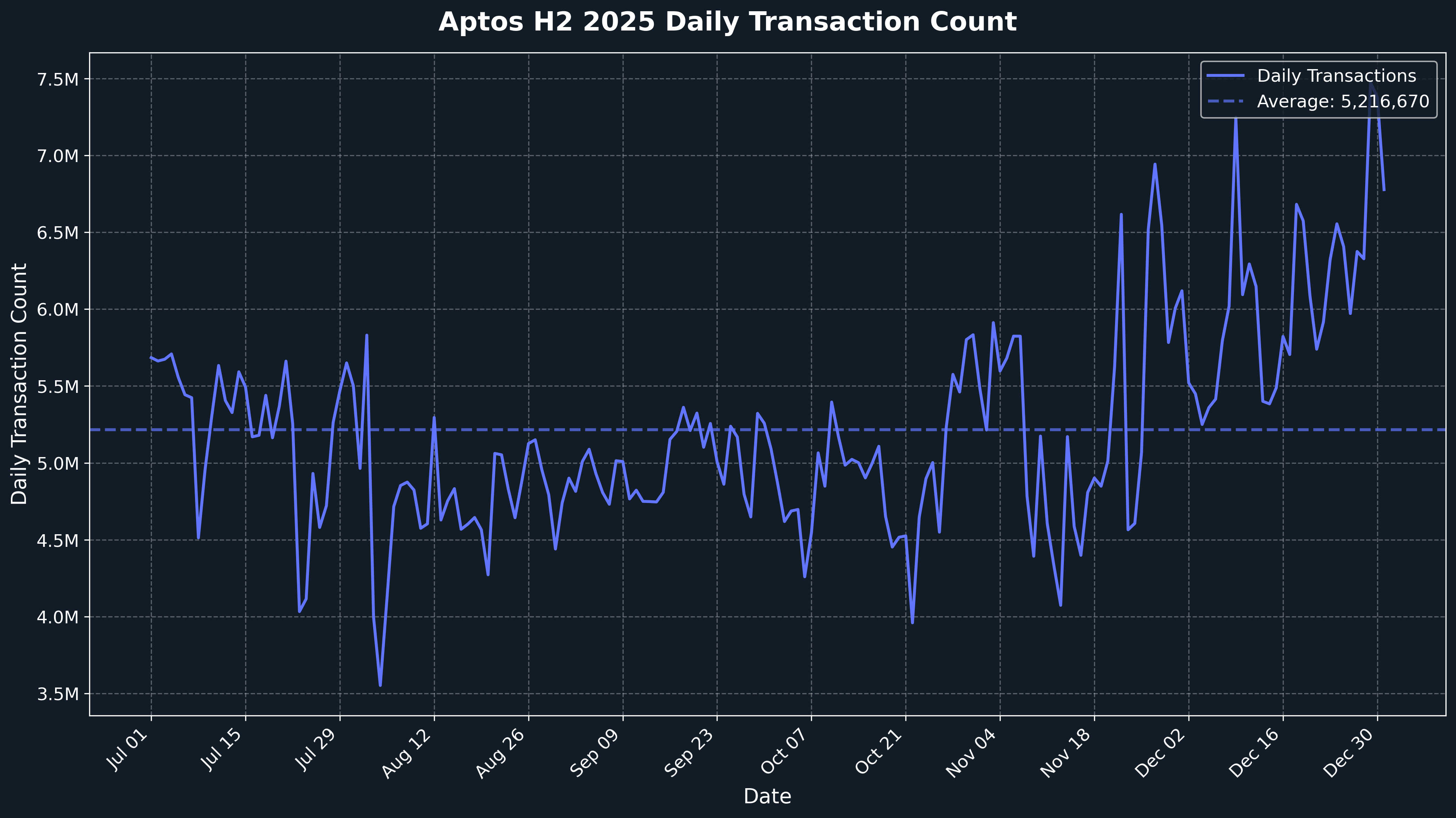

Daily Transactions

Aptos processed substantial transaction volumes throughout H2 2025, with daily transaction counts mostly ranging from approximately 3.5 million to 7 million transactions per day.

The network maintained relatively stable transaction volumes, averaging around 5.2 million transactions daily, demonstrating consistent usage and network reliability despite some entity-level fluctuations.

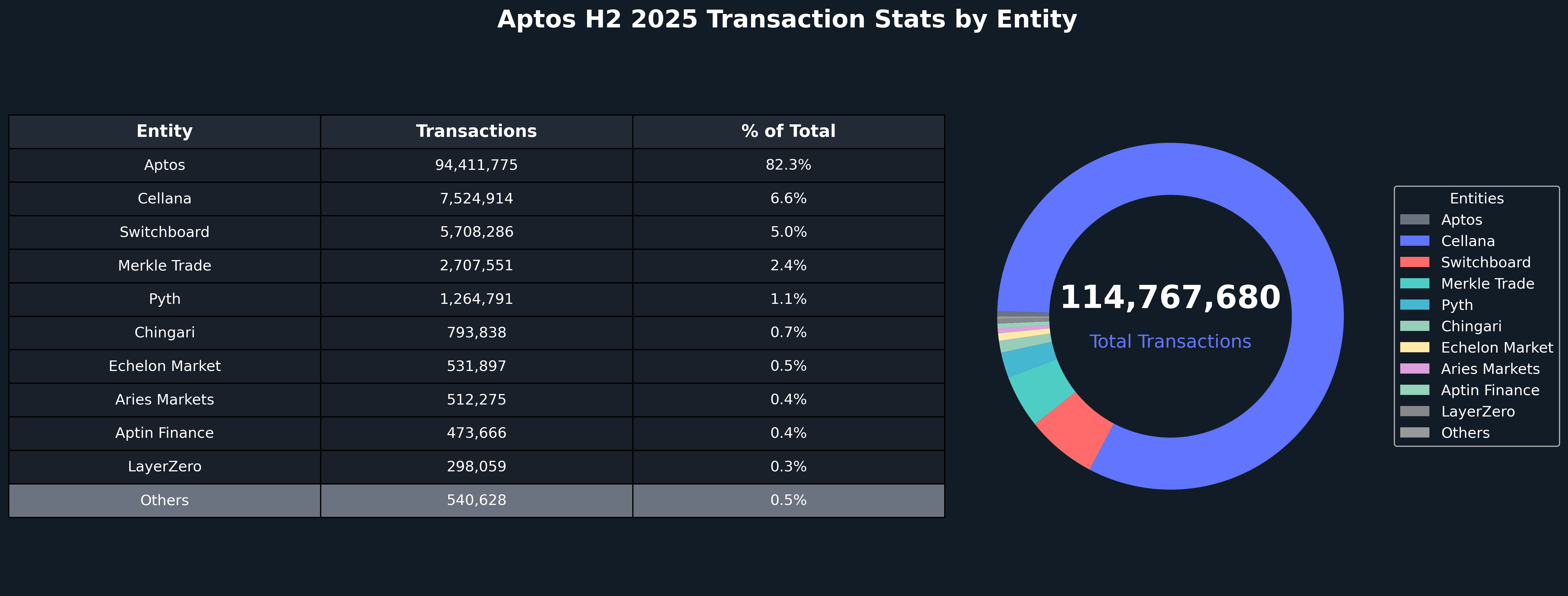

Top Entities by Users and Transactions

Aptos's top entities by users and transactions highlight a diverse ecosystem anchored by native infrastructure, DeFi protocols, and cross-chain interoperability platforms. Aptos led transaction volume with 94.4 million transactions (82.3% of total), though this represented a 32.78% decrease compared to H1 2025, likely reflecting network optimization and efficiency improvements. Cellana remained the top DEX with 7.5 million transactions (6.6% of total), despite a 33.08% decrease from H1 2025, continuing to serve as a primary liquidity venue for the ecosystem. Switchboard maintained strong infrastructure presence with 5.7 million transactions, while Echelon Market showed positive growth momentum, processing 532,000 transactions with a 21.04% increase compared to H1 2025, indicating growing adoption of lending protocols on Aptos and validating the protocol's position as the capital coordination layer for Aptos DeFi. Merkle Trade demonstrated growth with 2.7 million transactions (+6.02% HoH), indicating expanding trading activity.

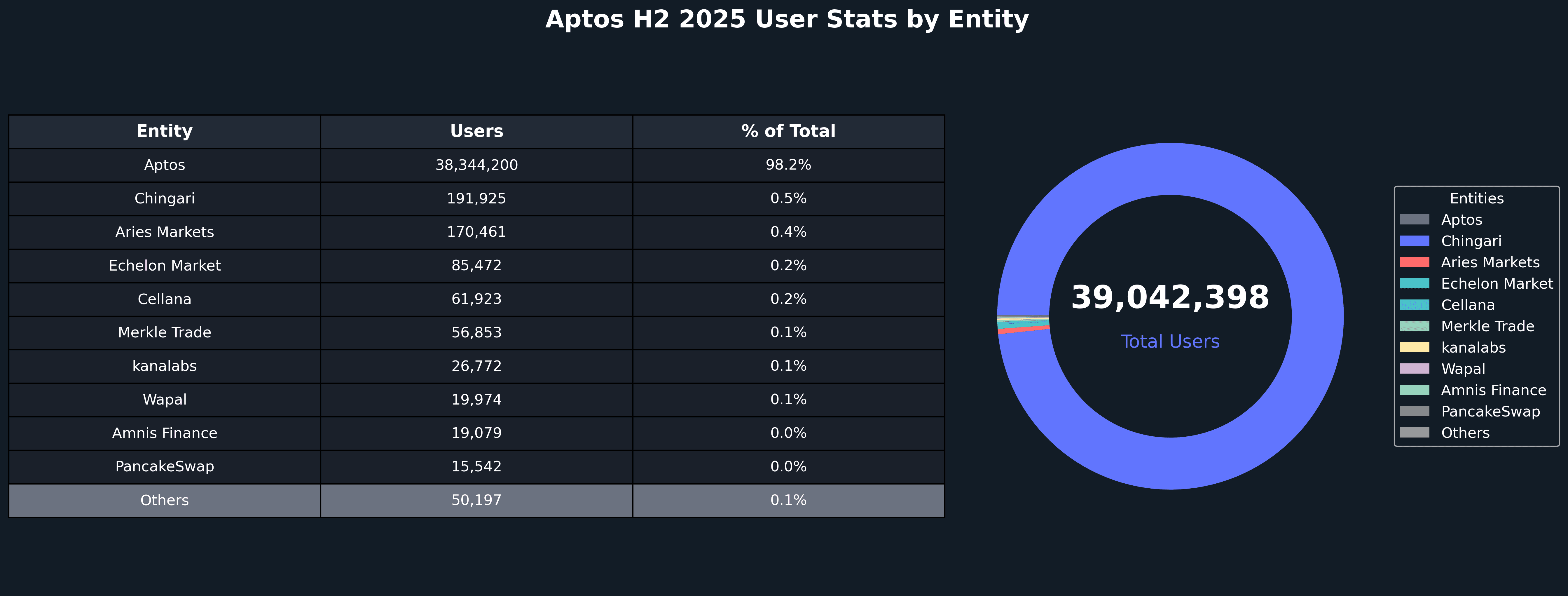

On the user side, Aptos led with 38.3 million users (98.1% of total), reflecting the network's core infrastructure role. The ecosystem's distribution reinforces Aptos's dual role as both a high-performance DeFi platform and enterprise-grade infrastructure for institutional finance, with native infrastructure and DeFi protocols serving as the foundational layer for both retail and institutional adoption.

Closing Thoughts

H2 2025 has established Aptos as production-grade blockchain infrastructure capable of supporting both institutional finance and decentralized applications, with the network demonstrating exceptional technical achievements, regulatory compliance, and global ecosystem expansion. The half-year's developments showcase a clear evolution from a high-performance Layer-1 to infrastructure trusted by major financial institutions, stablecoin issuers, and DeFi innovators. The introduction of major protocol upgrades including Archon, Block-STM v2, and Encrypted Mempool, combined with the passage of the GENIUS Act validating Aptos' Fungible Asset Standard design, signals Aptos' growing recognition as a compliant, high-performance platform for next-generation financial applications requiring both technical excellence and regulatory alignment.

Onchain metrics tell a compelling story of network stability and ecosystem maturation. With daily transaction volumes averaging 4.8-5 million and maintaining consistent levels throughout H2 2025, Aptos demonstrated its capacity to handle substantial workloads while maintaining sub-50 millisecond block times and sub-cent fees, validating the network's positioning as high-performance blockchain infrastructure. Aptos enters 2026 poised to further demonstrate how high-performance blockchain infrastructure can serve both traditional finance and decentralized applications, establishing itself as a preferred platform for the next generation of financial infrastructure and global money movement.